SAF-T in Portugal

Introducing SAF-T

Due to an increasing number of businesses, using electronic systems to deal with daily operations such as invoicing, and to the subsequent increase in the number of software solutions available in the market, the Portuguese government issued, in 2007, a law that instated the use of SAF-T files to provide all relevant accounting information to fiscal agents, during inspections.

Software manufacturers were required to include in their systems a feature that would allow, for a given fiscal year, the generation of these standardized files, following OECD guidelines, to facilitate data verification and treatment and eliminate the need for auditors to know in detail how each software operated.

It was a measure that contributed to the:

- Simplification of fiscal procedures

- Acquisition of better and more accurate information

- Reduction of fulfilment costs for taxable persons

Portugal was the first country in the world to adopt the SAF-T file as a tool to improve efficiency and control and prevent fraud and tax evasion

Software Certification

The success of this measure coupled with the understanding that the data provided by the SAF-T files could be tampered with and promote new situations of tax evasion led, in 2009, to the issuance of a new law that required existing software manufacturers to certify, under the supervision of the Tax Authority, each of their accounting / invoicing solutions.

New rules were implemented to ensure data inviolability and only previously certified systems were authorized to be used by taxable persons.

The new law was introduced gradually, being, at first, only applicable to taxable persons with sales above € 150.000 or more than 1.000 issued invoices per year. It was later extended, under new laws, to other taxable persons with commercial activity.

Going Beyond Invoicing

In 2012, the Portuguese government introduced significant changes to the SAF-T file. Until then, the file had only been used to summarize information regarding invoices issued during a given fiscal year. With the approval of a new law, the concept was extended to accommodate information regarding other documents with fiscal relevancy, including sales slips, way bills and invoices printed in typographies.

The fight against fraud and tax evasion was intensified, focusing not only on the end sale but also on the movement of goods, across the entire distribution channel.

Some facts about e-invoincing in Portugal

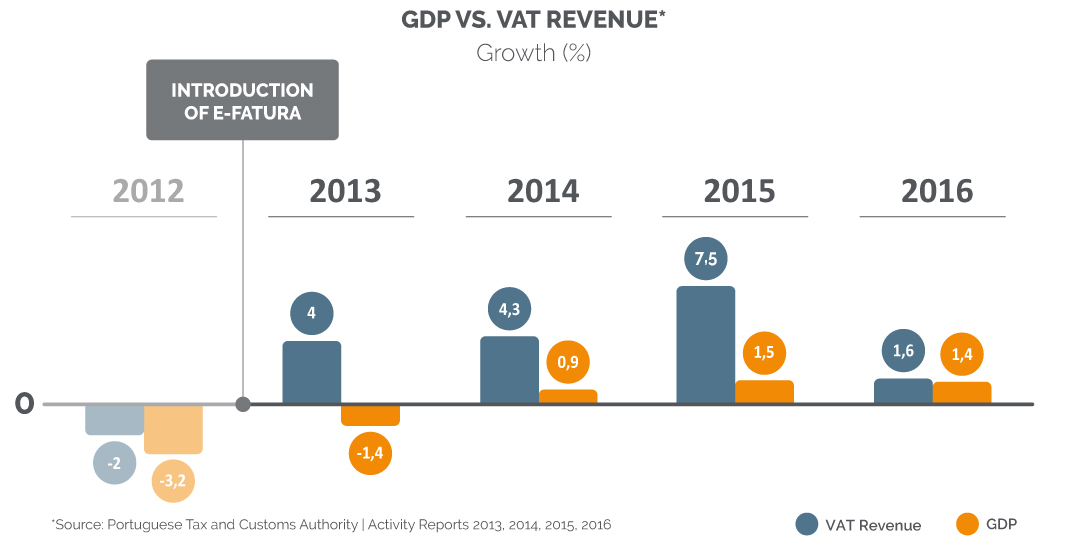

The introduction of both the SAF-T file and e-Fatura have proven to be extremely successful over the years, as we can see by the comparison of yearly VAT revenues and GDP growth: